What is the Limited Partner Council?

Chair: Chris Sears, Truist Community Capital

Members of SBIA participate in industry councils for sector-specific updates on policy and regulatory matters and educational opportunities. The LP Council convenes regularly to discuss relevant issues and time-sensitive topics. LP Council meetings often feature subject matter experts from a range of industries and fund types and offer an interactive, industry-specific forum for members to discuss topics of interest to investors.

The Small Business Investor Alliance believes in the importance of maintaining a strong and healthy alignment of General Partners and Limited Partners. Our association represents the entire lower middle market investing ecosystem, and as such represents a diverse range of institutional investors that invest in lower middle market small businesses. SBIA regularly engages with members of Congress, regulatory agencies and outside stakeholders to promote small business capital formation, often working with industry coalitions to impact tax policy and other issues that impact this class of investors.

What are Limited Partners?

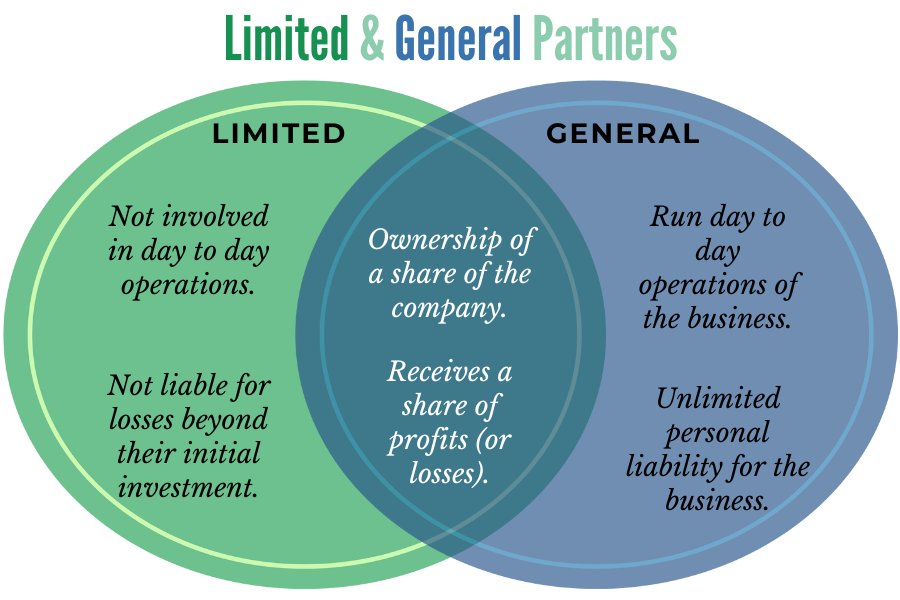

In simple terms, Limited Partners (LPs) commit capital to private equity funds managed by General Partners. LPs serve as trusted financial stewards who direct critical capital into private equity investments on behalf of their beneficiaries, which may include public pensions, insurance companies, family offices, universities, and charities. LPs only receive dividends if and when a fund they invest in produces returns, often waiting years to realize returns from investments made with their capital. By legal definition, an LP is a qualified investor that has limited liability for a company's debts and restricted responsibilities for a company’s daily operations.

Resources

Industry News

The Small Business Investor Alliance expresses strong support for the “Investing in Main Street Act”, bipartisan legislation that is designed to increase investments into American small businesses.

Read MoreThe Small Business Investor Alliance announces its 2023-2024 Board of Governors, including Board Officers, Regional Chairs, At-Large Board Members, and designated Council Chairs. Caroline Ducas, a founding partner of Nashville-based Resolute Capital Partners, is the incoming Chair.

Read MoreThe newly launched Independent Sponsor Forum is a national platform designed specifically to serve the needs of the growing independent sponsor market.

Read More